Venmo

Designing a High Impact Feature for an Existing Product

DesignLab UX Academy Case Study

Duration: 80 hours over 2 weeks

Project Brief

For this hypothetical project, I worked with Venmo, a subsidiary of Paypal. They are looking to expand their social payment capabilities for their mobile app. Venmo, the #3 top rated financial app in the iOS App Store is looking to add a new feature that will help them to remain at the top of the charts and stand out amongst the competition. They would like to round out their offerings by providing users with updated features that will ultimately allow them to better manage their personal finances and continue to utilize the app.

Goals & Objectives

Develop a feature that is perfectly integrated into the brand’s existing app

Design additional and complementary features that could enhance the main new feature

Design a feature that is backed by research and is easy to use

The Process

Research

Competitor Analysis

Surveys

Define

User Persona

Product Feature Roadmap

Task Flow

User Flow

Product Requirements

Design

Sketch Ideations

Wireframes

Test

Mid Fidelity Prototype

Usability Testing

Affinity Map

Priority Revisions

Research

Challenges

Without any specific requirements or direction, I anticipated this project to have a huge emphasis on research— especially competitor research in order to develop a feature that is not currently being offered or (if it is) can be vastly improved. Additionally, I expected to gain the most out of my user research— to best understand the needs of current Venmo users to discover what sort of feature would be the most beneficial for them. I looked to target existing Venmo users to gain a better sense of how they currently use Venmo, and what their payment habits look like.

Main Goals

Identify users’ motivations to use Venmo

Identify users’ expectations when using Venmo

Identify users’ pain points and frustrations when using Venmo

Define what feature could best aid in alleviating these frustrations for existing Venmo users

Methodologies

Due to the nature of the project, I focused on choosing methodologies that would provide me with the most valuable insights within the time restrictions.

Competitor Analysis

Evaluate both direct and indirect competition of Venmo and evaluate strengths and weaknesses

Survey

Reach a larger audience to gain insight and understanding of current users’ motivations & pain points

In addition to the surveys and competitor analysis, I initially I planned on conducting 1 on 1 user interviews to gather more qualitative data from my users. I anticipated that I would not be able to get a large enough sample of survey responses to be able to confidently decide what feature would be desired by potential users. To my surprise, the findings from both the survey and the competitor analysis provided information that I deemed to be strong enough that I could forgo administering the interviews. Instead, I planned on using that allocated time for later on; developing the feature and conducting more usability testing.

Competitor Analysis: Comparing features of other peer to peer payment applications as well as a digital wallet and a group payment application

Key Research Findings

User Goals

Everyone pays the correct amount when splitting bills

Easily complete transactions (both receiving and sending funds)

Accurately pay individuals, quickly

Receiving transferred funds in personal account quickly

Notable Findings

71% of participants report that the most frustrating thing about dealing with a bill with many people deals with calculations: tip, tax, splitting evenly, making sure everyone paid for what they got

54.5% of participants reported that they have asked to see the bill (sometimes or always)

Reasons to see the bill: insecurities around accuracy of charges, want to make sure that tip is correct, didn’t always know the attendees well

46.7% of users have used an additional app to calculate bills with many participants- primarily for vacations/multiple expenses with the same people

64.4% of participants reported that they think they’ve been charged more than they owed

71% of users have never used a personal finance management tool

Define

User Persona

I summarized the information gathered from the initial research to create a version of Venmo’s typical user. Key identifying characteristics like age, location, gender, and occupation were determined by analyzing the survey answers and selecting the most frequent responses. Enter, Kam Willis.

Kam’s personality traits, emotions, favorite brands and story were shaped and defined by the research findings.

Venmo User Persona

Developing a New Feature

After conducting the research and defining Venmo’s ideal user, I decided what sort of feature Venmo should have and started the process to bring it to life.

The most requested feature was for something that could help users better calculate what is owed to them, particularly for larger groups with multiple items. By providing a feature that accomplished this, Venmo’s users would have better management of their finances.

Developing a “Split a Bill” feature for users to upload their own receipts or manually add items seemed like a natural solution to the problem. This was a feature not offered by any other direct competitor.

Product Feature Roadmap

With a stronger understanding of the users’ goals, expectations, and frustrations, as well as those of the business, I developed a road map to establish the details of the new Venmo feature. I prioritized this list based on need, urgency, and time required to develop.

Task Flow

With a focus on the main task at hand, I created a linear task flow to show the steps and pages that a user would encounter when trying to split a bill with multiple friends.

This version of the task flow later evolved as the design process progressed. Actions like requiring users to select “Split Tax and Tip Evenly” were eventually phased out. From my research, I noticed that users discussed a concern of paying for items they didn’t buy (no mention of tax or tip). If anything, users were more concerned about not paying enough tip. I decided to create this as an automatic, even split; future usability testing would be used to help identify if this was something that needed to be modified further.

Task Flow

User Flow

Expanding upon the task flow and considering all possible decisions a user may face when utilizing this new feature, I created a user flow. Similarly to the task flow, this evolved during the design process in an effort to better reflect the research gathered as well as make using the feature easier and more intuitive.

User Flow

Product Requirements

Referring back to the product roadmap, user flow, and task flow, I made a thorough list of product requirements (necessary pages or pop ups as well as detailed elements and overarching goals) that would allow users to successfully complete tasks.

Tasks included:

User arrives to the main page in the Venmo app and wants to split a bill

User wants to check a receipt in a payment request that has been sent to them

Design

Sketch Ideations

Lo-Fidelity Wireframes

My main focus in creating the the lo-fi wireframes was ensuring that the new feature pages would integrate seamlessly within the existing application. I referenced back to the app for inspiration when adding new details to maintain visual cohesion. It was very important during this stage to make sure that I had an understanding of the established patterns.

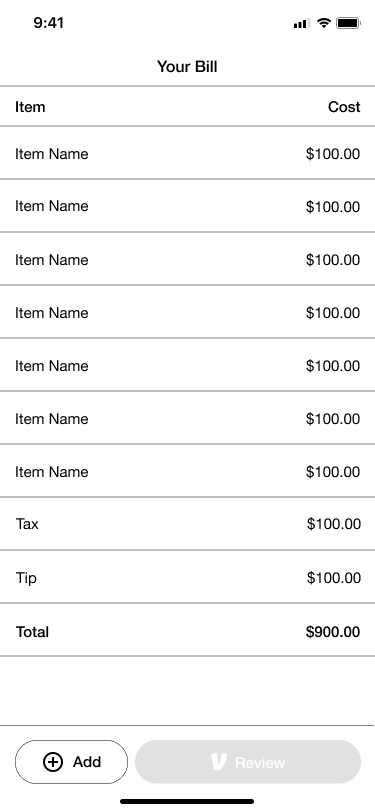

Hi-Fidelity Wireframes

Building off of the lo-fidelity wireframes, I was able to bring the Venmo brand to life by including their colors and logo. For this first iteration, I reworked the layout of certain pages to simplify the process and created any additional screens or buttons that were necessary to accomplish major tasks of the user.

As I worked through the hi-fidelity wireframes, I thought ahead to my usability testing. I made note of any areas that I would potentially need to focus on— any jargon, placement, etc. that I anticipated could be potentially challenging for users.

Test

Prototype

I created an interactive mid-fidelity prototype in Figma that would be used to administer my usability testing. Using the screens from my hi-fidelity wireframes, I aimed to create the most realistic experience for my usability test participants.

The full prototype can be found here

Usability Testing

I conducted the usability test virtually on the mid-fidelity prototype with 5 participants. The participants were asked to attempt 3 main tasks. The tasks included uploading and assigning items on a receipt to several friends, checking a request notification’s receipt, and removing an item from the bill they uploaded.

I documented how the users navigated the pages, if they were able to accomplish the tasks, as well as any emotions or suggestions they noted. Using the information gathered from the usability testing, I was able to later apply this and make appropriate and necessary iterations to the design.

Affinity Map

I created an affinity map to organize the information collected during my usability testing. By doing so, I was able to note opportunities where I could improve the new feature and how it was integrated based on participants’ frustrations and suggestions.

Key Takeaways:

All of my participants left the session with a strong understanding of what what the new Venmo feature offered, and all felt that it was well integrated into the existing app.

4 out of 5 participants rated the ease of using the new feature an 8 out of 10. Of those users, 100% of their errors were self corrected, and felt that it was intuitive

100% of the participants felt that this feature would make their life easier

Participants’ habits within the existing Venmo app varied, which showed especially as they navigated through the new feature

See the full affinity map here

Priority Revisions

Based on the findings from my usability testing, I implemented a few immediate modifications to my design. These changes were organized based on their ability to meet the client’s goals as well as that of the user. While I feel that the most current iterations will help curb the frustrations and challenges my participants discussed in the testing, if the timeline allowed for it, I would hope to conduct more usability tests and adjust or add to the design as needed!

Immediate Changes

Add a “New” icon next to the Split a bill feature to help draw users’ eyes and make them aware of the new feature

Added instructions for item assignment on the bill page

Include subtotal on the Add a Tip page so users did not need to recall the information

Future Changes

I would hope to conduct research and better understand how frequently Venmo’s users utilize the “Scan” feature. Several of my usability participants mentioned never or rarely using this, so replacing the “Scan” button on the homepage with a “Split a Bill” feature button may be more beneficial.

Depending on the performance and use of the feature with the directions and “New” button, I would consider integrating the split a bill option into one of the existing Venmo flows (most of my participants attempted to use the feature in a way that they added names first and then wanted to select to split a bill).

Evolving the “Split a Bill” feature to allow for multiple receipt uploads as well as simplified payments for groups on trips or groups with recurring purchases

Concluding Thoughts

Using my research to shape the feature that I created was extremely beneficial. Instead of creating a feature I thought people wanted, I was able to develop something I knew they wanted. Having this confidence backed by research made the process seamless. Whenever I had doubts, I knew I could always look to the information I gathered to guide me.

I would have loved to have the opportunity to continue to test and iterate on the hi-fidelity versions. If time allowed for it, I would have focused on both current Venmo users as well as those who have not used Venmo or were newer to the app. The choices made throughout the process were carefully considered based on the research and the goals of both the business and existing users. In an attempt to widen their audience (and in turn, grow their business!), I would want to work to make Venmo more accessible for all.